NFTs and Blockchain Culture: A Critical Perspective by Three Experts

On March 10, JCU Media Studies lecturer Alberto Micali hosted a talk called “NFTs and Blockchain Culture,” as part of the Communications Department Digital Delights and Disturbances Lecture Series. Professor Micali invited three experts to discuss NFTs and blockchain culture: Felix Stalder (professor of Digital Culture at the Zurich University of the Arts), Geraldine Juarez (a Mexican-Swedish artist and writer), and Andrea Baronchelli (Associate Professor in Mathematics at City, University of London).

NFTs and Blockchain Culture

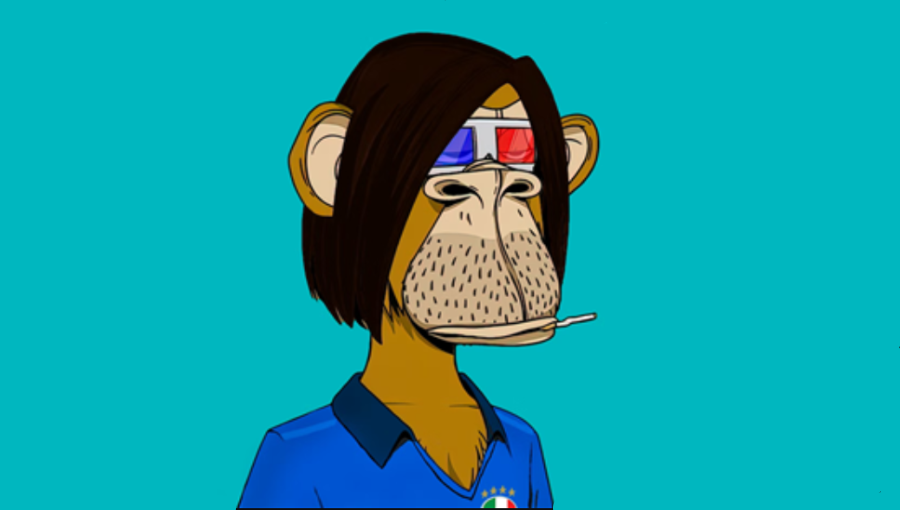

NFTs (Non-Fungible Tokens) are unique cryptographic tokens that exist on a blockchain and cannot be replicated.

Felix Stalder began the conversation by analyzing the controversy surrounding digital currencies, “the engine that moves the NFT market.” According to Stalder, it is questionable whether “cryptos” can be considered currencies. To be regarded as currencies, “financial assets must be a unit of account, a store of value, and a medium of exchange,” which cryptocurrencies are not. To demonstrate his thesis, Stalder referred to Ethereum, the crypto that is mainly used to exchange NFTs. Due to its volatility, it is almost impossible to give it a stable and reliable value, which prevents Ethereum from becoming a store of value or a medium of exchange. This downgrades digital currencies to the category of financial assets, or more precisely, speculative assets.

Geraldine Juarez then joined the discussion. Making reference to her essay The GhostChain, she stressed the concept of the “internet of assets and money.” Juarez described cryptocurrencies as assets transformed into revenue-generating resources, which triggered the transformation of art from a commodity to an asset. Through those assets, investors can access this new layer of the internet, the internet of money. The abundance of profit-seekers then builds a regime of dominance, described by the writer as an unstable cultural economy in which asset prices, not wages, drive investment choices.

Andrea Baronchelli presented the results of a study in which he and his team analyzed market trends, trade networks, and visual features of six million NFT transactions. After categorizing NFTs, Professor Baronchelli demonstrated that NFT traders tend to specialize in collections and categories. This is likely because certain NFTs belonging to the same category are visually similar to each other. Also, the analysis suggested that most NFTs are sold for lower prices than can be predicted, despite what is usually thought.

“Cryptos are voracious of people, they thrive as people invest, while NFTs can thrive through small communities and ghost chains, which are blockchains without value, with toxic assets, a monument for a future we don’t want.”

(Giovanni Petra)